🏧borrow

mint fxTokens using ETH and more..

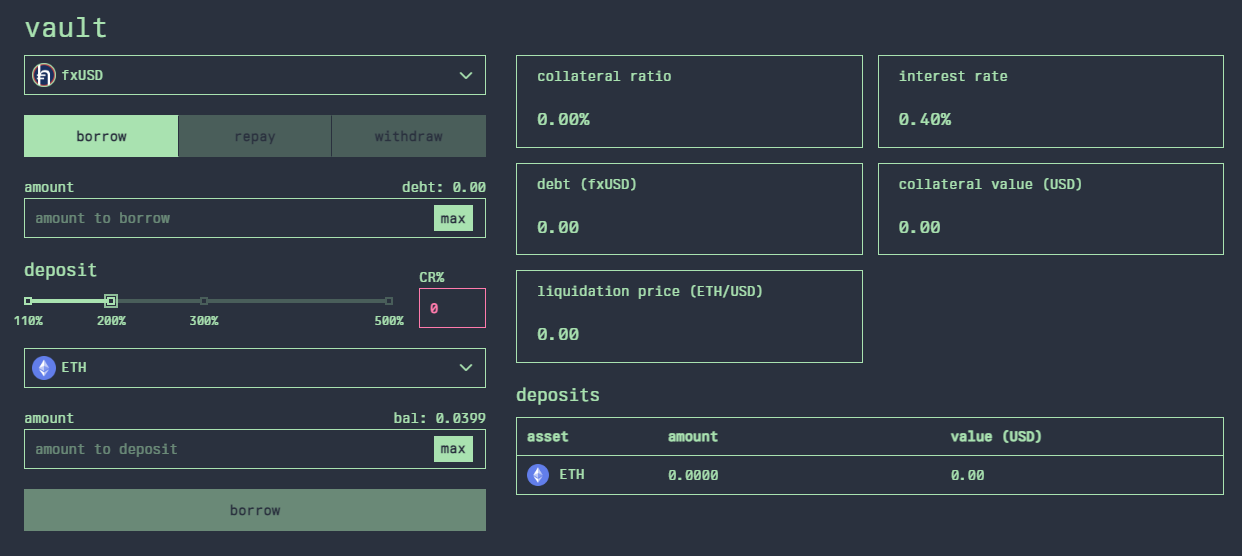

participants which use handle.fi borrow mechanism can mint a range of fxTokens through the use of an over collateralised debt position. the individual collateralized debt positions are called vaults.

users lock up collateral to an fxToken vault and may issue a range of handle.fi's fxToken stablecoins to their address. initially accepted collateral will be ETH however over time additional collateral will be added; including a range of ERC20 tokens and later, the platform's own $FOREX token.

collateral ratio or c-Ratio is a measure of the amount of collateral that is required to borrow a certain amount of money. it is calculated by dividing the total amount of collateral by the total amount of outstanding loans.

initial proposed fxTokens that can be minted are:

fxUSD - United States Dollar.

fxAUD - Australian Dollar.

fxCNY - Renminbi.

fxEUR - Eurodollar.

FxJPY - Japanese Yen.

fxKRW - Korean Won.

fxCHF - Swiss Franc.

fxSGD - Singapore Dollar.

a protocol fee of 0.0% is charged to mint fxTokens.

there are some important metrics to be aware of when electing to open up a vault. they are:

minimum collateral ratio (c-Ratio/ CR): in order to ensure each fxToken of debt is appropriately backed the amount of debt issued needs to be managed relative to the collateral posted. the minimum c-ratio in order to mint fxTokens is 200%. more information about min c-ratio and how liquidations work can be found here.

interest rate: the rate is currently set at 0.40% for all fxTokens. the rate is variable and determined by the DAO.

liquidation fee: when a c-Ratio falls below the liquidation threshold then a fee is charged out of the vault issuer's collateral. the fee is currently 10% and is determined by the DAO with 50% going to fxKeeper pool & 50% to the protocol.

rewards will accrue to fxToken minters, but only for users that maintain a c-Ratio greater than their vault's required minimum c-Ratio.

for a complete tutorial on how to make a loan see this guide

Was this helpful?