🏛️CDP vaults and collateral

vaults and acceptable assets to secure the minting of fxTokens

a collateralised debt position (CDP) vault is a smart contract that allows users to deposit collateral in exchange for fxTokens, a decentralized multicurrency stablecoin. the collateral can be any asset that is approved by handle.fi, currently only allows for ETH but will have a wider range in the future.

borrowing fxTokens against your CDP allows you to maintain the upside potential of your ETH while having liquidity in the form of a decentralised stablecoin. with the fxToken you have an ERC-20 token which can be used throughout handle.fi to trade, convert, earn or even hold as a currency hedge.

fxTokens are backed by user deposited collateral in a vault.

the amount of fxTokens you can borrow is limited by the amount of collateral you have deposited. handle.fi uses a liquidation ratio to determine how much collateral you need to maintain in order to avoid liquidation. if the value of your collateral falls below the liquidation ratio, your CDP will be liquidated and you will lose your collateral.

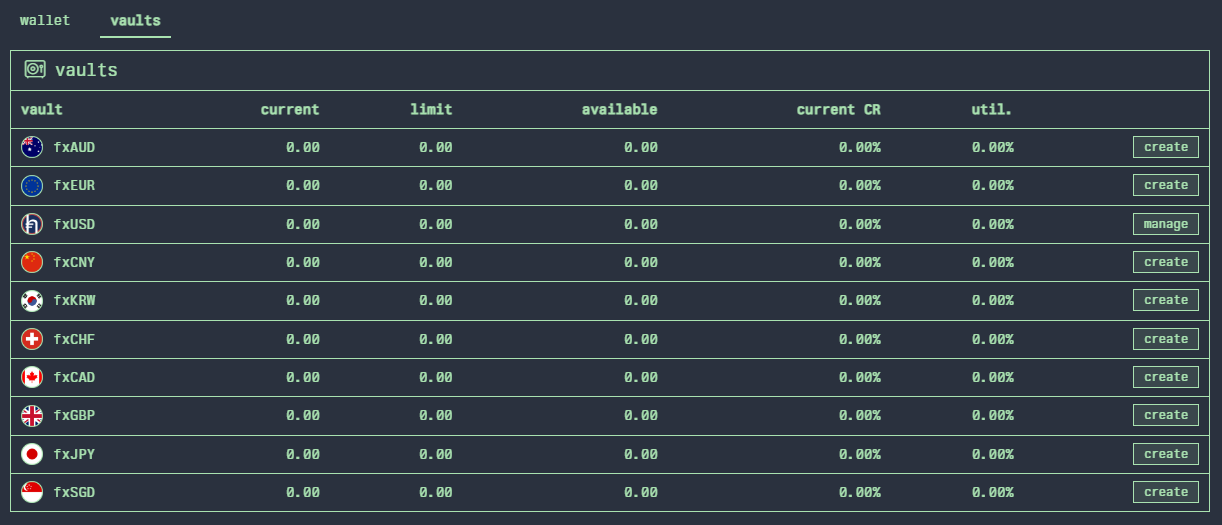

users can have multiple vaults but each vault can only issue one fxToken currency e.g. fxAUD, fxJPY, fxCNY

the dashboard provides a summary of all your vault positions and provides an overview of all the key metrics to monitor:

current: is the amount of the fxToken borrowed against the vault.

limit: is the maximum which you can take out of that fxToken to keep your c-Ratio at the minimum required amount.

available: how much more of the fxToken you can borrow before you reach your limit. it is calculated by: 'available' = 'limit' - 'current'

current CR: what is your c-Ratio at these prices. collateral ratio or c-Ratio is a measure of the amount of collateral that is required to borrow a certain amount of money.

util.: percentage of total available debt you have taken out. it is calculated by: 'util.' = 'current'/ 'limit'.

Was this helpful?