📗how to borrow

borrow in multi-currency stablecoins by minting fxTokens

the purpose of this guide is to provide a tutorial on how to deposit collateral into a vault and then mint fxTokens against it. fxTokens can be used throughout handle.fi to hedge, speculate or make payments.

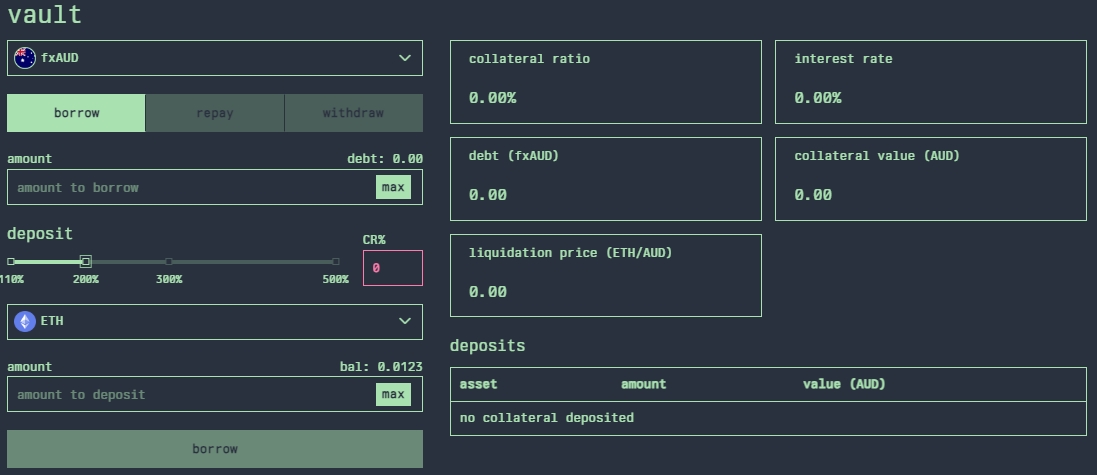

borrow dashboard

the dashboard displays a number of useful metrics that you can use to your advantage:

collateral ratio or c-Ratio or CR: is a measure of the amount of collateral that is required to borrow a certain amount of money. it is calculated by dividing the total amount of collateral by the total amount of outstanding loans. the minimum c-ratio in order to mint fxTokens is 200%.

interest rate: the rate is currently set at 0.40% for all fxTokens. the rate is variable and determined by the DAO.

debt: the amount of the outstanding loan in your denominated fxToken currency.

collateral value: the amount of collateral you have posted to your vault in terms of your denominated fxToken currency.

liquidation price: the price at which your c-ratio falls below 160% and will begin to be liquidated.

deposits: this will display all the necessary information about the assets which you have deposited into your vault such as asset type, amount and value.

make sure you understand all the mechanics of opening up a CDP before undertaking the process.

video tutorial

initiating a loan

select which asset you wish fxToken you wish to take out as a loan. the dropdown menu will include all the borrowable currencies available.

next step is to select borrow from your three options; borrow, repay & withdraw. this will be the only possible selection if you don't currently have any open vaults.

then select the asset you wish to deposit into the vault to borrow against. we are currently adding more assets to accept for collateral in a vault. the current assets handle.fi accepts are:

ETH/ wETH

select the desired amount of fxToken you wish to borrow. you may enter the value manually or select the 'MAX' function in the box. the 'MAX' function will provide the maximum new fxTokens to mint based on your pre-existing collateral if your c-ratio > 200% OR the value of total collateral in your wallet at the minimum c-ratio of 200% (or whichever is higher if a user has already provided a value in the field prior to selecting MAX).

once an amount of fxToken is selected then your c-ratio will update and any additional collateral required to achieve the minimum c-ratio of 200% will displayed below. the price and value of the required collateral in the denomination of the fxToken will also be displayed.

you may increase the amount of collateral required to achieve a c-ratio > 200% if you want additional margin against unfavourable price movements in the underlying collateral. you may adjust your collateral in the 'amount' box or by sliding the 'CR%' bar (noting the minimum of 200%).

confirm all the details of your vault are correct and proceed by selecting the 'borrow' bar.

Was this helpful?